stock option sale tax calculator

Click to follow the link and save it to your Favorites so. NSO Tax Occasion 1 - At Exercise.

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

60 of the gain or loss is taxed at the long-term capital tax rates.

. This permalink creates a unique url for this online calculator with your saved information. Your basis in the stock depends on the type of plan that granted your stock option. Those shares could be worth 10 per share or 1000 per share.

Section 1256 options are always taxed as follows. And if you re-purchase the stock. The following table shows an example of how much stock option values would be at various growth levels for an employee who annually obtained 1000 stock option grants at a strike.

Short-term capital assets are taxed at your ordinary income tax rate up to 37 for. When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Youre basing your investing strategy not on long-term considerations and diversification but on a short-term tax cut. If you exercise a non-statutory option for IBM at 150share and the current market value is 160share youll pay tax on the 10share difference 160 - 150 10. Ad Fidelity Has the Tools Education Experience To Enhance Your Business.

Basic Long Call bullish Long. On this page is an Incentive Stock Options or ISO calculator. Option Exercise Calculator This calculator illustrates the tax benefits of exercising your stock options before IPO.

Capital Gains Tax Calculator. Taxes for Non-Qualified Stock Options. How much are your stock options worth.

Check out our free Capital Gains Interactive Calculator that in just one screen will answer your burning questions about your stock sales and give you an estimate of how much. The number of shares acquired is listed in box 5. The spread the difference between the.

Most transactions of goods or services between businesses are not subject to sales tax. 40 of the gain or loss is taxed at the short-term capital tax. Regarding how to how to calculate cost basis for stock sale you calculate cost basis using the.

Non-qualified Stock Option Inputs. If you sell the stock when the stock price is 10 your theoretical gain is 9 per sharethe 10 stock price minus your 1 strike price. All thats necessary to calculate the value of startup stock options is A the number of shares in the.

Employee Stock Option Calculator Estimate the after-tax value of non-qualified stock options before cashing them in. To start select an options trading strategy. Lets say you got a grant price of 20 per share but when you exercise your.

Please enter your option information below to see your potential savings. Locate current stock prices by entering the ticker symbol. Ad Fidelity Has the Tools Education Experience To Enhance Your Business.

The tax rate on long-term capital gains is much lower than the tax rate on ordinary income a maximum rate of 20 on most long-term capital gains compared with a maximum rate of 37. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your. Options Profit Calculator provides a unique way to view the returns and profitloss of stock options strategies.

On the date of exercise the fair market value of the stock was 25 per share which is reported in box 4 of the form. Unlike VAT which is not imposed in the US sales tax is only enforced on retail purchases. This calculator lets you estimate how much it will cost you to exercise your options or will help you compute the gain in a given exercise and sale scenario.

Exercising your non-qualified stock options triggers a tax. Depending on how long you hold your capital asset determines the amount of tax you will pay. Build Your Future With a Firm that has 80 Years of Investment Experience.

Modern Vector Template For Your Medical Project Infographic Medical Projects Medical Icon

Quarterly Tax Calculator Calculate Estimated Taxes

Capital Gain Calculator On Sale On Property Mutual Funds Gold Stocks Capital Gain Mutuals Funds Capital Gains Tax

Cara Menghitung Penghasilan Tidak Kena Pajak Ptkp Ptkp Ini Merupakan Salah Satu Komponen Terpenting Dalam Peng Tax Services Accounting Services Filing Taxes

Garage Sale Calculator Inventory List And Item Tracker Table Garage Sales Spreadsheet Excel Templates

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure

Capital Gains Tax Worksheet Excel Australia Capital Gains Tax Capital Gain Spreadsheet Template

Stock Management System System Management Stock Information

Google Image Result For Http Www Zippycart Com Images Infographics Operation Ecommerce Infographic Infographic Marketing Social Media Infographic

Sample Loan Payment Schedule Template

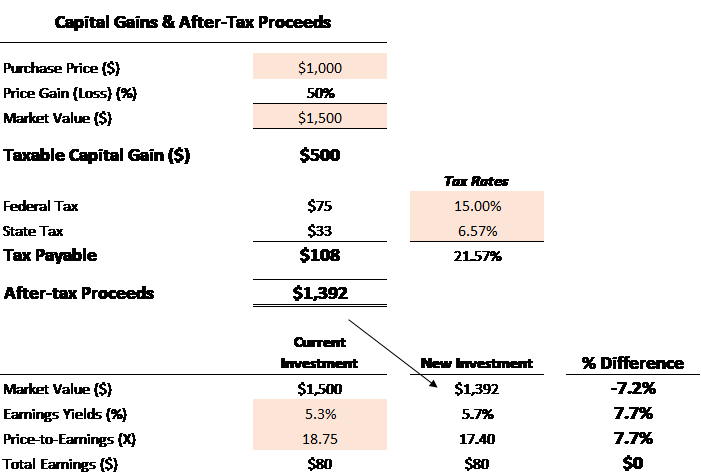

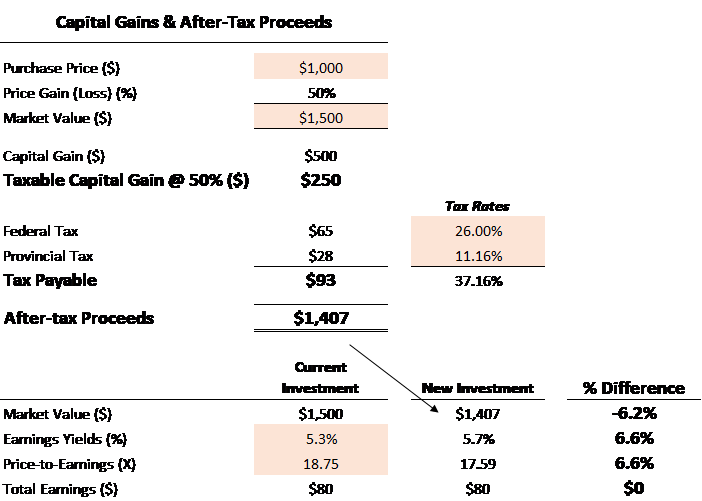

Capital Gains Tax Calculator For Relative Value Investing

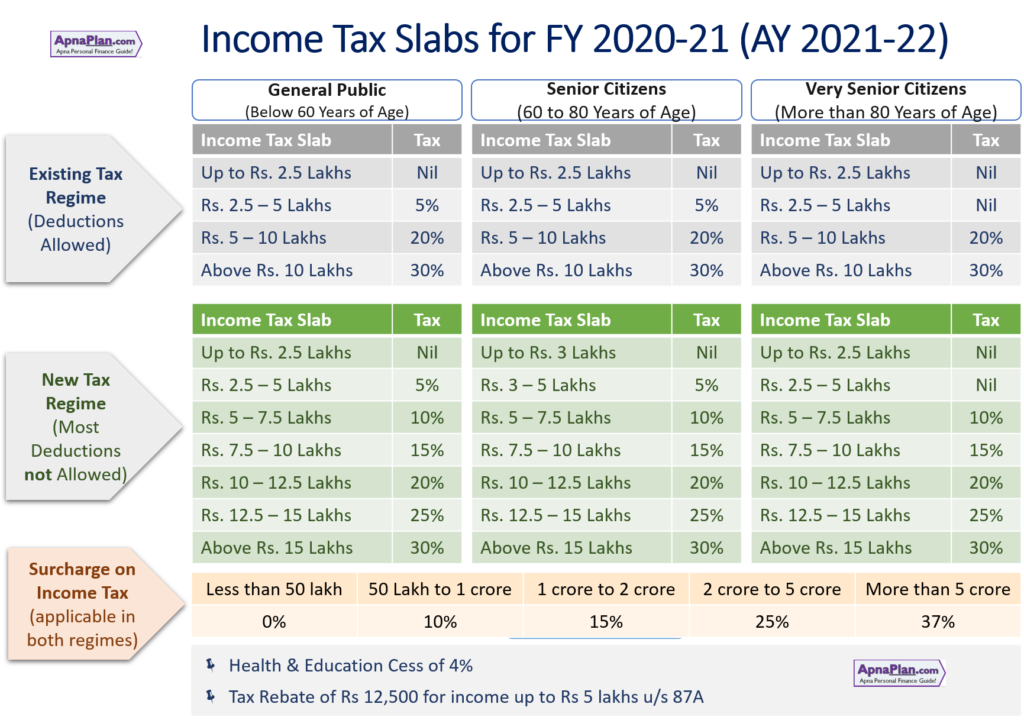

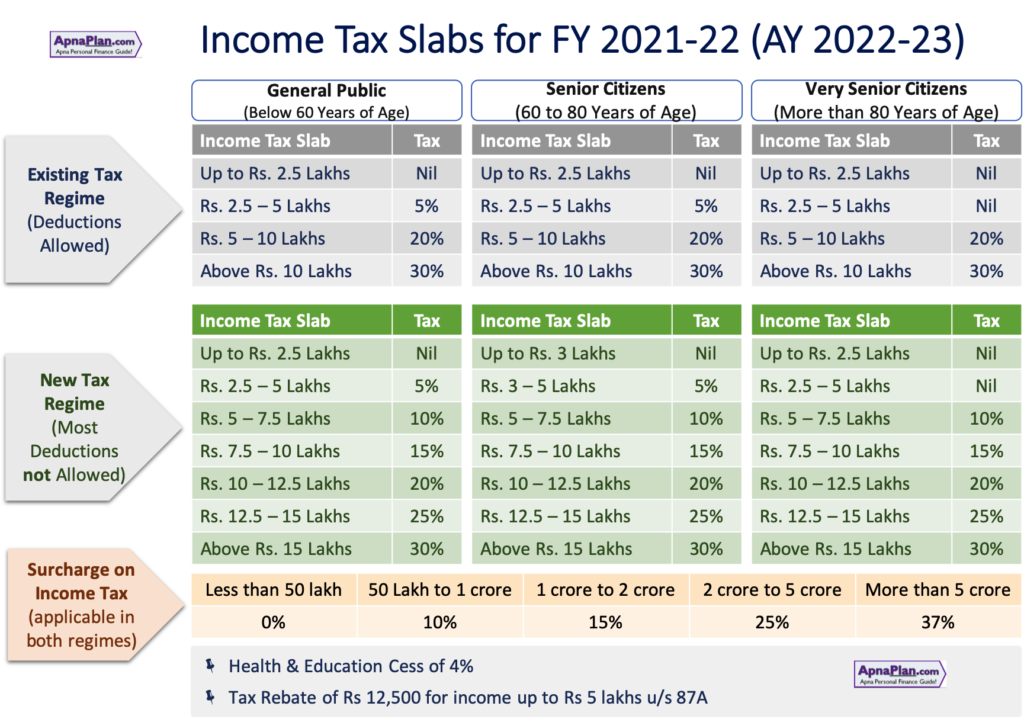

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Home Buying Excel Spreadsheet Check More At Https Onlyagame Info Home Buying Excel Spreadsheet Investment Analysis Income Property Budget Spreadsheet

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure

Locating And Discovering Sales Tax Medical Icon Sales Tax Tax

Trading Infographic Fundamental And Practical Facts For Personal Investor Forexlearntrade Investing Finance Investing Finances Money

Capital Gains Tax Calculator For Relative Value Investing

Wacc Formula Cost Of Capital Financial Management Charts And Graphs

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas